The Mortgage Files

Nationally syndicated mortgage news and advice from Senior Loan Officer Scott Sheldon.

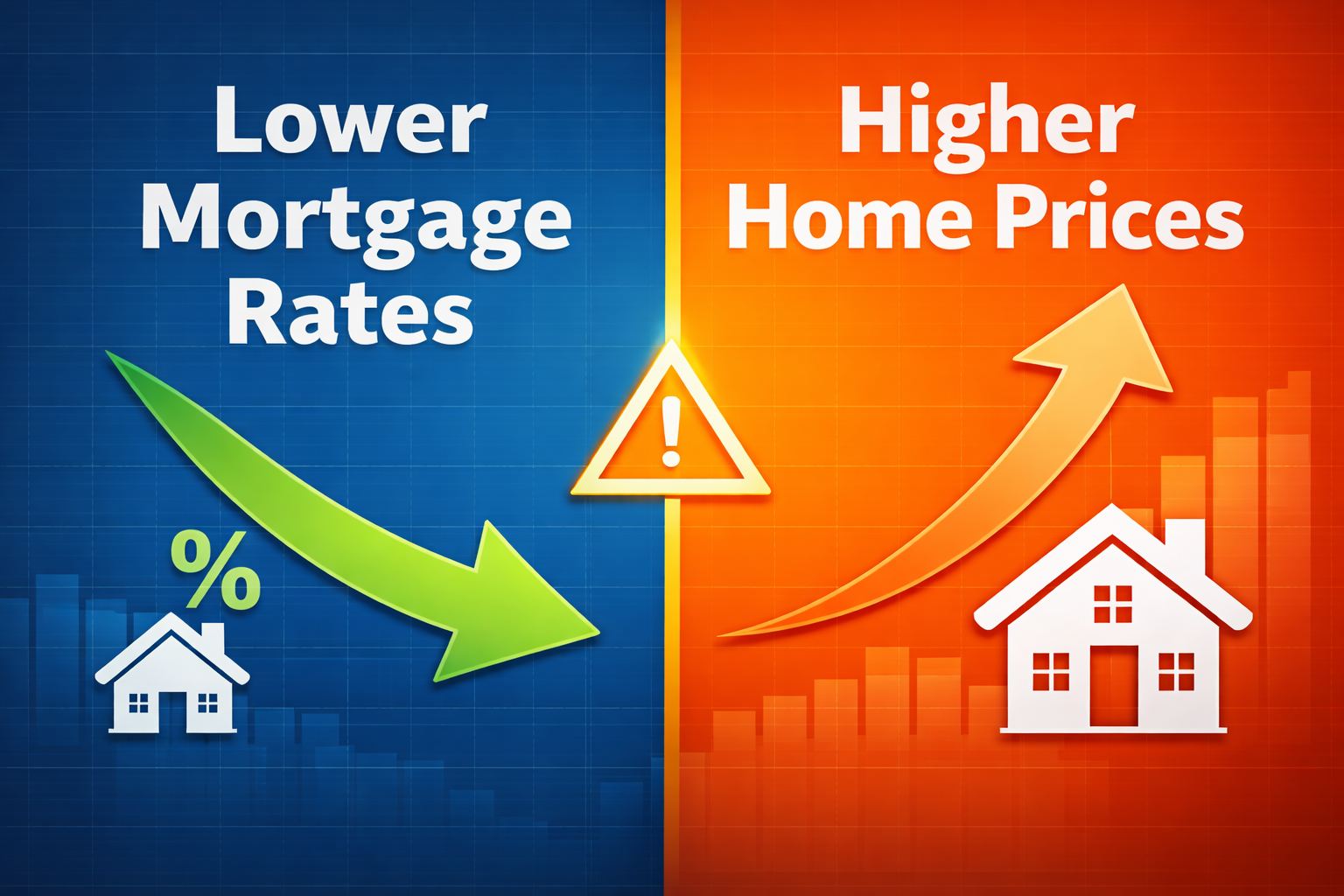

Lower Rates vs. High Prices – The Tradeoff You Can’t Ignore

Everyone loves the idea of lower mortgage rates—and for good reason. A lower rate means a lower monthly payment and more buying power. But here’s the part that often gets overlooked: when mortgage rates fall, home prices often rise. And sometimes, those rising prices can cancel out the benefit of a lower rate. This creates…

Read More about Lower Rates vs. High Prices – The Tradeoff You Can’t IgnoreMortgage Rate Forecast: What to Watch and Why Timing Is Tough

Let’s face it—everyone wants to know when mortgage rates will drop. Whether you’re buying your first home, refinancing an existing loan, or just watching from the sidelines, it’s tempting to wait for the “perfect” rate. But here’s the truth: no one can predict how low mortgage rates will go, not even the experts. That’s because…

Read More about Mortgage Rate Forecast: What to Watch and Why Timing Is ToughTiming the Market: How to Know When It’s the Right Time to Buy a Home

Everyone dreams of buying a home at just the right moment—when prices are low, rates are perfect, and the competition has cooled off. The reality? Perfect timing in real estate is nearly impossible. What you can do is focus on the practical factors that tell you when it’s the right time for you to buy,…

Read More about Timing the Market: How to Know When It’s the Right Time to Buy a HomeWorried About a Low Appraisal? Here’s What You Need to Know Before Refinancing

In the current real estate market, homeowners considering refinancing are increasingly concerned about the implications of home appraisals. Appraisals play a crucial role in determining a property’s value, directly influencing loan-to-value (LTV) ratios and, consequently, the terms and approval of refinancing applications. Understanding the nuances of appraisal risks is essential for homeowners aiming to make…

Read More about Worried About a Low Appraisal? Here’s What You Need to Know Before RefinancingWhy Home Insurance Is Skyrocketing in California—and What Buyers Should Know

Climate Change and Mortgage Challenges: Navigating Homeownership in California In recent years, climate change has emerged as a significant factor influencing various aspects of homeownership, particularly in California. From escalating insurance premiums to challenges in refinancing and purchasing homes, residents are navigating a complex landscape shaped by environmental and economic forces. Rising Insurance Costs Amid…

Read More about Why Home Insurance Is Skyrocketing in California—and What Buyers Should KnowUnderstanding Home Inspection Reports: Facts Buyers Must Know

Understanding Home Inspection Reports: Facts Buyers Must Know When buying a home, the inspection phase can feel like a whirlwind of new information. After you’ve agreed on a price with the seller, the home inspection report often provides insights you weren’t initially aware of. While valuable, these reports can sometimes lead to unnecessary worry. Here’s…

Read More about Understanding Home Inspection Reports: Facts Buyers Must KnowWhy the Media is Not Your Friend When It Comes to Mortgage Rates

When it comes to understanding mortgage rates, relying solely on media sources can be misleading. The best barometer for where mortgage rates truly stand is the actual source: FreddieMac.com. This is the entity that buys the loans made and sold by mortgage aggregators. When you see headlines claiming that interest rates are lower or have…

Read More about Why the Media is Not Your Friend When It Comes to Mortgage RatesShould You Buy a Home with a 401(k) Loan or Down Payment Assistance?

Buying a home is a significant financial decision that requires careful planning and consideration of various financing options. Two common methods prospective homeowners might consider are borrowing from a 401(k) and utilizing down payment assistance programs. Each approach has its benefits and drawbacks, and understanding these can help you make an informed decision tailored to…

Read More about Should You Buy a Home with a 401(k) Loan or Down Payment Assistance?