This can be accomplished in a variety of ways, but the most common way is to take the monthly savings you generate by refinancing your home and divide it into the capital idea closing costs required to complete the refinance. If you can breakeven in 2 to 3 years, this in most cases is normal although in some instances taking longer to recuperate still very well make sense if you plan to keep the loan.

Alternatively, another option is to take the interest savings that you’re going to generate by completing a refinance in relationship to the current interest you’ll pay on your loan moving forward.

Not sure how to calculate the numbers? Call Scott at 707-217-4000.

Or get started with a complementary mortgage rate quote to see how the numbers play out.

Share:

RELATED MORTGAGE ADVICE FROM SCOTT SHELDON

Why a Federal Reserve Rate Cut Doesn’t Automatically Lower Mortgage Rates

On September 17th, 2025, the Federal Reserve cut interest rates—a move that had many people…

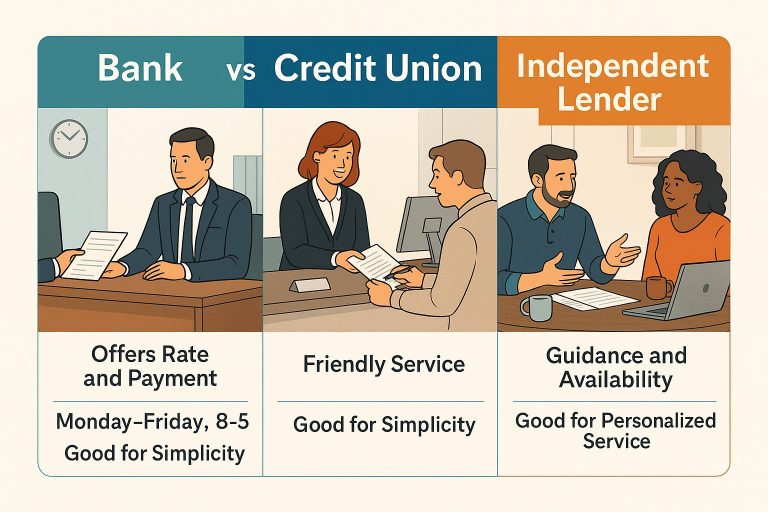

Bank vs Credit Union vs Independent Lender: Which Is Right for You?

When it comes to getting a mortgage, you have three main options—banks, credit unions, and…

Why Lenders Request the Same Documents More Than Once

If you’ve ever applied for a mortgage, you’ve probably wondered why lenders sometimes ask for…

View More from The Mortgage Files:

begin your mortgage journey with sonoma county mortgages

Let us make your mortgage experience easy. Trust our expertise to get you your best mortgage rate. Click below to start turning your home dreams into reality today!