The Mortgage Files

Nationally syndicated mortgage news and advice from Senior Loan Officer Scott Sheldon.

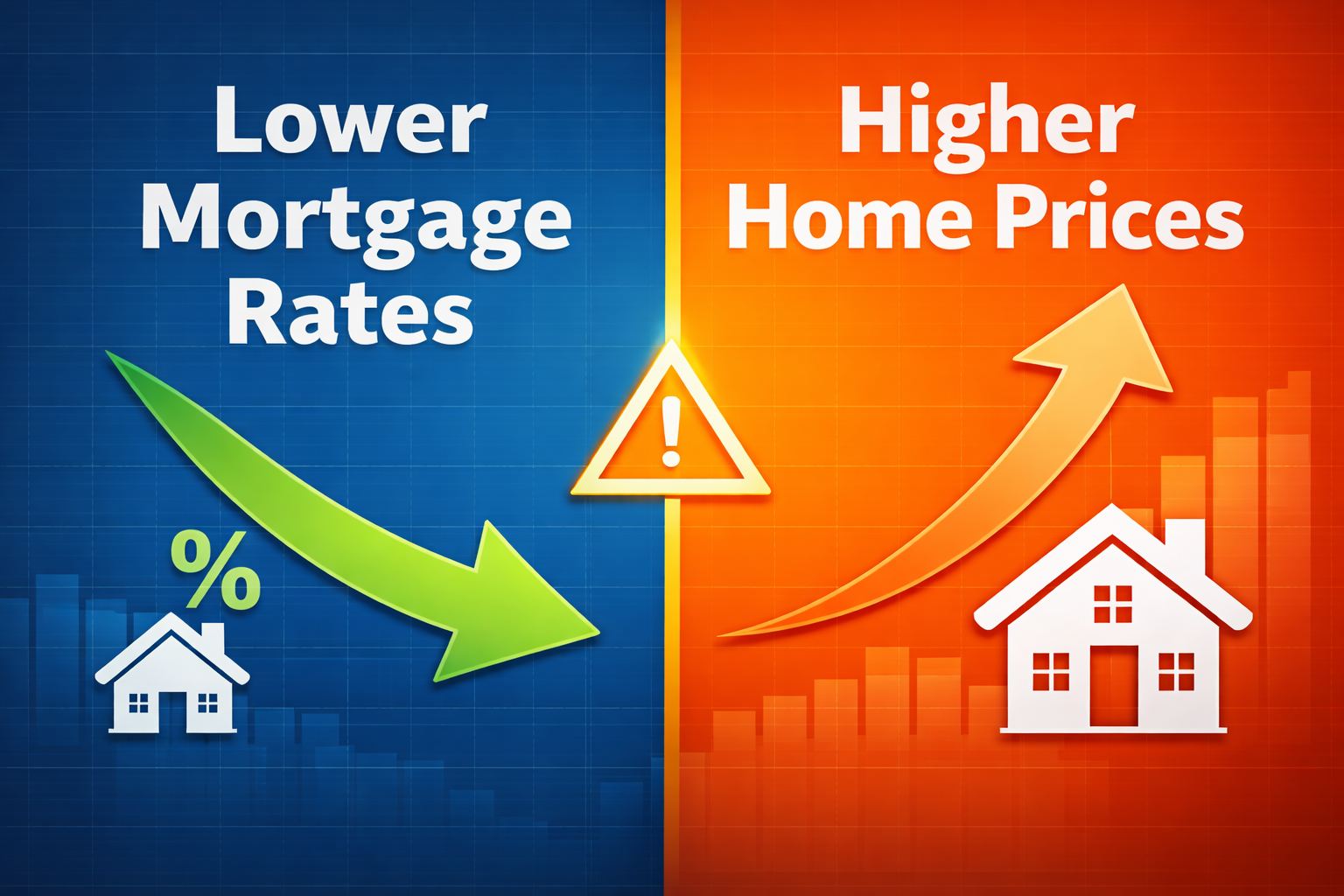

Lower Rates vs. High Prices – The Tradeoff You Can’t Ignore

Everyone loves the idea of lower mortgage rates—and for good reason. A lower rate means a lower monthly payment and more buying power. But here’s the part that often gets overlooked: when mortgage rates fall, home prices often rise. And sometimes, those rising prices can cancel out the benefit of a lower rate. This creates…

Read More about Lower Rates vs. High Prices – The Tradeoff You Can’t IgnoreMortgage Rate Forecast: What to Watch and Why Timing Is Tough

Let’s face it—everyone wants to know when mortgage rates will drop. Whether you’re buying your first home, refinancing an existing loan, or just watching from the sidelines, it’s tempting to wait for the “perfect” rate. But here’s the truth: no one can predict how low mortgage rates will go, not even the experts. That’s because…

Read More about Mortgage Rate Forecast: What to Watch and Why Timing Is ToughTiming the Market: How to Know When It’s the Right Time to Buy a Home

Everyone dreams of buying a home at just the right moment—when prices are low, rates are perfect, and the competition has cooled off. The reality? Perfect timing in real estate is nearly impossible. What you can do is focus on the practical factors that tell you when it’s the right time for you to buy,…

Read More about Timing the Market: How to Know When It’s the Right Time to Buy a HomeWhen Seller Carry Financing Makes Sense

When Seller Carry Financing Makes Sense For some buyers, qualifying for a traditional mortgage isn’t always possible—or practical. Maybe the property is too unique for a conventional loan, or the buyer’s credit profile doesn’t meet lender standards. In specific cases like these, seller carry financing—also called seller financing or owner financing—can bridge the gap and…

Read More about When Seller Carry Financing Makes SenseThe Only Three Real Obstacles in the Loan Process: Credit/Income and Appraisal

For many homebuyers, getting a mortgage can feel like navigating a maze of paperwork and requirements. There are phone calls to return, documents to upload, and deadlines to meet. But when you boil it down, there are really only two key hurdles that can stop a loan from closing: the borrower’s credit and income, and…

Read More about The Only Three Real Obstacles in the Loan Process: Credit/Income and AppraisalUnderstanding Home Inspection Reports: Facts Buyers Must Know

Understanding Home Inspection Reports: Facts Buyers Must Know When buying a home, the inspection phase can feel like a whirlwind of new information. After you’ve agreed on a price with the seller, the home inspection report often provides insights you weren’t initially aware of. While valuable, these reports can sometimes lead to unnecessary worry. Here’s…

Read More about Understanding Home Inspection Reports: Facts Buyers Must KnowShould You Lock or Float Your Mortgage Rate? Here’s What to Consider

When you apply for a mortgage, one of the key decisions you’ll need to make is whether to lock in your interest rate or let it “float.” This choice can impact your monthly payment and your overall financial comfort, so let’s explore both options to help you decide. What Does It Mean to Lock Your…

Read More about Should You Lock or Float Your Mortgage Rate? Here’s What to ConsiderTips for Buying or Refinancing a Home with a Low Credit Score

If you’re considering buying a home or refinancing your current mortgage but have concerns about your credit score, there’s good news: you still have options. While a higher credit score certainly makes the process easier, lenders today offer flexible solutions for buyers and refinancers with credit scores that are less than perfect. Understanding how credit…

Read More about Tips for Buying or Refinancing a Home with a Low Credit Score