The Sonoma County Market is presenting opportunity for those seeking to purchase real estate. For everyone purchasing property with financing listen up because this pertains to you! If you are seeking a mortgage loan and live in Santa Rosa, Petaluma, Windsor, Healdsburg, or even Sebastopol.. remember a preapproval letter is what you will need to make a purchase offer on a property. This means the lender you selected to handle your home loan will need to write a letter to give to your realtor so you can make an offer. This is extremely critical and it’s important that you get this letter done within 24 hours of submitting your offer.

A mortgage preapproval is the same thing as a pre-underwrite. This means you send in all of your financials including pay stubs, tax returns, bank statements into the mortgage lender.

The review of your file will also include making sure you know exactly what your payment, down payment and closing costs will be. This preapproval also includes an automated underwrite so you know you can actually get a mortgage loan. Make sure the lender that you are working with has ran this automated underwriting against your credit income and assets, it is imperative your lender does this for your Sonoma County home loan you are about to take out. You also need to allow your lender to pull a copy of your tri-merge credit report. If you already have a credit report that’s fine, but a second credit report is required by the lender because the credit report has to be in the name of the lender you are working with.

Okay so explain the difference between the preapproval and the prequalification for home financing.

A prequalification is a rough idea of how much you can qualify for. It does not carry any weight in a real estate purchase situation because no reputable lender will write a letter saying you are pre-qualified when they have not seen all of your financials. The purpose of a prequalification is to initially determine how much you can qualify for based upon income, credit and assets.

The prequalification is what lenders use to begin the process of obtaining a mortgage loan preapproval. Put another way, the prequalification is when you verbally give information to your lender and the preapproval is when you actually allow the mortgage lender you are working with to review your financial documentation to obtain financing.

Go for the mortgage preapproval because that’s what you’ll need to ultimately determine whether or not you can qualify for the loan.

Provide all of the information your lender asks for upfront. Don’t give the lender a copy of your old credit report and expect the letter to be able to use that credit report, it does not work work like that. Don’t give your lender half the information they need and then ask for a preapproval, your mortgage loan professional needs ALL financial documentation. Get a preapproval rate quote.

If you would like to get preapproved or would like to learn more about mortgage interest rates you can give me a call Scott Sheldon at 707-217-4000. I can give you information pertaining to your home purchase fast. We can discuss the differences between a mortgage preapproval versus a prequalification to see which makes the most sense for you.

Share:

Posted in:

RELATED MORTGAGE ADVICE FROM SCOTT SHELDON

Should You Consider an Adjustable Rate Mortgage?

When shopping for a home loan, most buyers immediately think of the 30-year fixed mortgage.…

Should you buy rental property for cash flow or appreciation?

When you invest in real estate, one of the first decisions you face is whether…

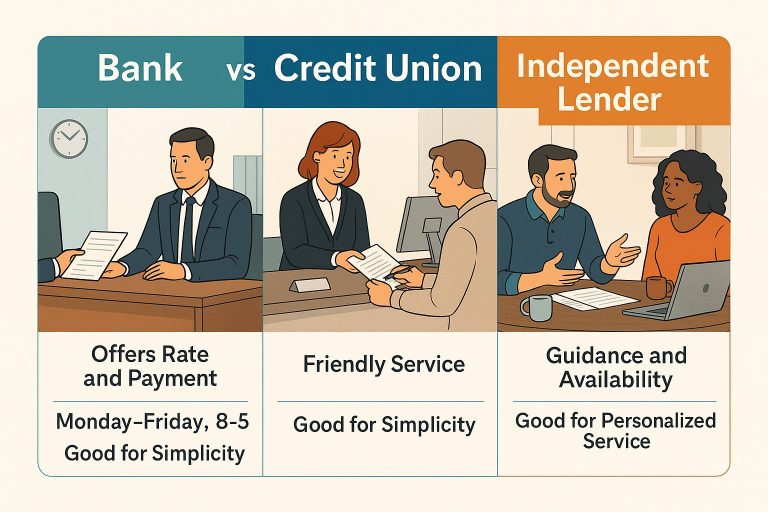

Bank vs Credit Union vs Independent Lender: Which Is Right for You?

When it comes to getting a mortgage, you have three main options—banks, credit unions, and…

View More from The Mortgage Files:

2 Comments

begin your mortgage journey with sonoma county mortgages

Let us make your mortgage experience easy. Trust our expertise to get you your best mortgage rate. Click below to start turning your home dreams into reality today!

[…] With a decent credit score, documented job stability/income and even without down payment, purchasing a home today is really quite […]

[…] So you went ahead and applied for a mortgage loan and you’re all geared up to refinance refinance at today’s fantastic interest rates and your lined up to be preapproved to purchase a house. […]